Vietnam is on its way to rapidly transform into one of the most dynamic emerging countries in the East Asia region. Evidently, the average GDP growth was 6.34% from 2000 until now. This is because Vietnam’s legal barriers are relatively loose compared to countries, making market entry easier for foreign companies. As a result, it is humble to declare that Vietnam is an attractive destination for foreign investors.

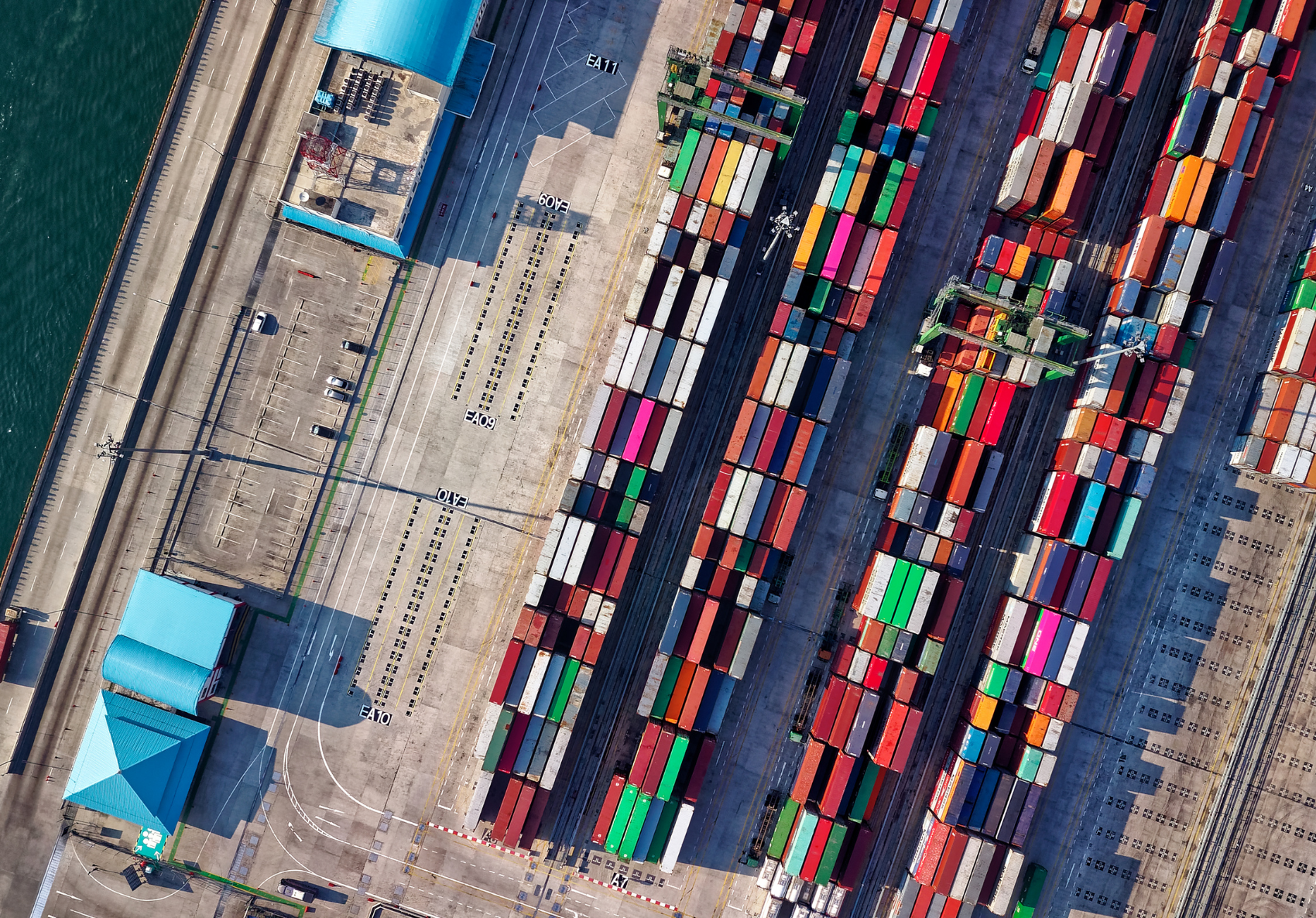

While the world slowly emerges from the pandemic, investors are looking to set up their operations in Vietnam. To clarify the process, in this article, Metasource provides an overview of the Customs Clearance in Vietnam process for foreign businesses.

Customs Regulations

Stated by national regulations, all imports and exports in Vietnam must meet the customs clearance standard listed under Law No.54/2014/QH13. Despite the listed requirements, Metasource highly recommends that foreign companies consult a regional expert on customs regulations to comply with Law No.54.

Required Documents for Customs Clearance in Vietnam

Below are the following documents that foreign companies must submit to Vietnamese customs authorities:

- Company business registration certificate

- Import/ Export business code registration certificate

Furthermore, customs authorities may request additional documents depending on the type of good:

Imports

- Declaration form

- Bill of lading

- Certificate of origin

- Import permit of restricted goods

- Commercial invoice

- Report of inspection

- Cargo release order

- Delivery order

- Packing list

- Health and technical certificate

- Terminal handling receipts

Exports

- Electronic Declaration form

- Bill of lading

- Certificate of origin

- Permit of export

- Contract/agreement

- Commercial invoice

- Packing list

- Health and technical certificate

- Terminal handling receipts

Customs Clearance Processing Time

The import process is much more time-consuming compared to the export process. For export, the shipment procedures are usually complete within the same day. However, the processes for imports may take longer, which typically conclude within one to three days. Particularly, Full Container Load (FCL) often takes one day, and Less Than Container Load (LCL) takes three days.

Priority Customs Clearance in Vietnam

Besides the basic process of Custom Clearance, foreign companies may consider applying for priority treatment to reduce compliance costs. However, only companies that meet the Decree No.08/2015/ND-CP standards are eligible for priority treatment. Still, to determine eligibility for priority treatment, Metasource recommends that foreign companies work with Vietnamese experts.

Benefits of Priority Customs Treatment

For example, suppose a company is qualified for the priority customs treatment. In that case, the business will be able to enjoy the following benefits of customs compliance and costs:

- Exemption from goods physical inspection

- Exemption from examination of supplementary customs documentation

- Able to submit incomplete customs declarations and complete within 30 days

- Priority regarding tax formalities

At Metasource, we offer recruitment, hosting, and legal services to foreign companies looking to start or expand to Vietnam. For more information, you can contact us at info@demo.metasource.co to receive a free consultation.